The Ultimate Guide To Kam Financial & Realty, Inc.

The Ultimate Guide To Kam Financial & Realty, Inc.

Blog Article

Excitement About Kam Financial & Realty, Inc.

Table of ContentsKam Financial & Realty, Inc. Fundamentals ExplainedThe smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking AboutExamine This Report on Kam Financial & Realty, Inc.The Ultimate Guide To Kam Financial & Realty, Inc.6 Simple Techniques For Kam Financial & Realty, Inc.Not known Incorrect Statements About Kam Financial & Realty, Inc.

When one thinks about that home loan brokers are not needed to file SARs, the real quantity of mortgage fraud task might be a lot greater. (https://www.startus.cc/company/kam-financial-realty-inc). As of early March 2007, the Federal Bureau of Investigation (FBI) had 1,036 pending mortgage scams investigations,4 compared with 818 and 721, respectively, in both previous yearsThe bulk of home mortgage fraudulence falls under two broad classifications based upon the motivation behind the fraudulence. commonly involves a consumer who will certainly overemphasize earnings or asset worths on his or her economic statement to receive a loan to purchase a home (mortgage lenders california). In a number of these instances, assumptions are that if the income does not increase to fulfill the repayment, the home will be offered at a make money from gratitude

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

The large bulk of fraudulence circumstances are discovered and reported by the institutions themselves. According to a research study by BasePoint Analytics LLC, broker-facilitated scams has actually appeared as the most common segment of home loan fraud nationwide.7 Broker-facilitated home mortgage scams occurs when a broker materially misrepresents, misstates, or leaves out info that a car loan police officer counts on to make the choice to expand credit rating.8 Broker-facilitated scams can be fraudulence for property, fraudulence commercial, or a combination of both.

A $165 million area bank determined to get in the home loan banking company. The bank acquired a tiny home loan business and worked with a skilled mortgage banker to run the procedure.

The Definitive Guide for Kam Financial & Realty, Inc.

The financial institution alerted its primary government regulatory authority, which after that called the FDIC as a result of the possible influence on the financial institution's monetary problem ((https://www.40billion.com/profile/114974493). Further investigation disclosed that the broker was operating in collusion with a home builder and an appraiser to flip buildings over and over again for higher, illegitimate profits. In total amount, even more than 100 loans were come from to one building contractor in the very same community

The broker rejected to make the payments, and the instance entered into lawsuits. The bank was at some point awarded $3.5 million. In a succeeding discussion with FDIC supervisors, the financial institution's head of state showed that he had actually always listened to that one of the most tough component of home mortgage financial was seeing to it you implemented the appropriate hedge to offset any passion rate risk the financial institution might incur while warehousing a significant quantity of home loan.

Getting My Kam Financial & Realty, Inc. To Work

The financial institution had depiction and warranty provisions in agreements with its brokers and believed it had option with respect to the loans being stemmed and offered via the pipe. Throughout the lawsuits, the third-party broker argued that the bank must share some obligation for this direct exposure since its inner control systems should have identified a loan concentration to this one class and set up steps to deter this danger.

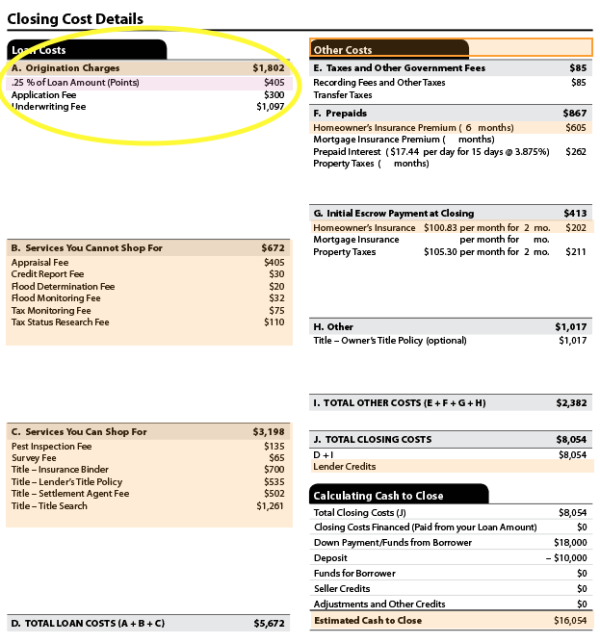

What we call a regular monthly home loan payment isn't simply paying off your home mortgage. Rather, think of a regular monthly home loan payment as the 4 horsemen: Principal, Passion, Residential Or Commercial Property Tax, and Property owner's Insurance policy (called PITIlike pity, because, you know, it raises your payment).

Yet hang onif you believe principal is the only amount to think about, you 'd be ignoring principal's friend: interest. It 'd be nice to think loan providers let you obtain their cash simply because they like you. While that could be real, they're still running an organization and intend to put food on the table too.

The 30-Second Trick For Kam Financial & Realty, Inc.

Interest is a percentage of the principalthe quantity of the car loan you have actually left to settle. Interest is a percent of the principalthe amount of the finance you have actually delegated pay back. Mortgage rates of interest are constantly transforming, which is why it's wise to choose a home loan with a fixed rate of interest so you know just how much you'll pay each month.

That would mean you 'd pay a tremendous $533 on your initial month's home loan payment. Get all set for a little bit of math right here. But do not worryit's not complex! Using our home mortgage calculator with the example of a 15-year fixed-rate home loan of $160,000 once again, the complete passion expense mores than $53,000.

6 Easy Facts About Kam Financial & Realty, Inc. Shown

That would certainly make your monthly home loan repayment $1,184 each month. Monthly Principal $1,184 $533 $651 The next month, you'll pay the exact same $1,184, but less will go to passion ($531) and a lot more will most likely to your principal ($653). That fad proceeds over the life of your mortgage until, by the end of your mortgage, virtually all of your repayment approaches principal.

Report this page